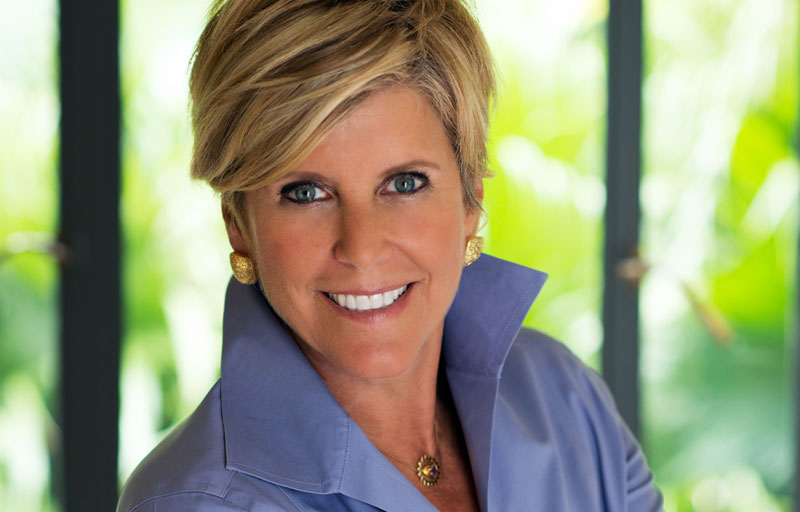

Financial Advice from Suze Orman

Knowing what not to do with your money is just as important as knowing what to do. In this article Suze Orman, America’s personal finance expert, details nine big money-wasting mistakes that you should definitely avoid making.

1. Waiting to Get Started Saving for Retirement

The biggest favor you can do yourself is to start saving ASAP. Someone who saves $250 a month starting at age 25 will have nearly $500,000 saved up by age 65, assuming a 6% annualized return. If she waits until age 40, saving $250 a month will give her a retirement pot of only $175,000 by age 65. If she starts at 40 and wants to end up with the same pot as her 25-year old self she will need to save $700 a month for those 25 years. That’s a tall order! Get started early and you can let the magic of compound growth help you more easily reach your goals.

2. Not Using a Credit Card

I agree with everyone who prefers to use a debit card. I think debit cards are such a smart way to only spend within your means. But you must also have at least one credit card that you use one or two times a month, and then always pay the full balance due. That’s because your debit card purchases do not help you build a credit score. Using a credit card responsibly is one of the key ways to build a strong credit score.

3. Paying Bills Late

Among the many factors that go into computing your credit score, your track record of making payments on time is one of the biggest. Even if you can’t pay a credit card bill in full, always make at least the minimum payment due. That’s good enough to score well on “timely” payments.

4. Taking Out a Long-Term Car Loan

The average car loan now stretches out to more than 60 months. And many of you are taking out loans that last 72 or 84 months. That is a sign you are spending way too much on a car. Your goal should always be to finance a car with a loan that is no more than 36 months. Yes, I realize that means buying a less expensive car. That’s exactly what I want you to do. Having a car may be a necessary part of your life, but it is a lousy investment. If you must borrow to purchase a car, your goal should always be to borrow the least amount possible with the shortest possible payback period.

5. Assuming Renting is a Waste

Unless you have a clear idea that career-wise and life-wise you are ready to settle down, renting can be the smarter move. My general advice is to never buy if you anticipate you might want to move within five years. The cost of selling can be 10% or so. If you move quickly, you may not make enough money on the sale to cover your selling and moving costs.

6. Using Private Student Loans

Federal Stafford loans taken out by the student should always be your first financing choice for college. If parents are in solid financial shape, they can take a look at borrowing a responsible amount through the federal PLUS program. But if you find yourself considering private loans that is a sign you are making a huge mistake. Most private student loans have variable rates, while federal loans are fixed. Now that interest rates in general are beginning to rise, that’s a huge issue. And federal loans offer far better repayment flexibility than private loans. Choose a different school rather than piling into private loans for a too-expensive school.

7. Relying on Life Insurance Through Work

Most companies offer employees a life insurance policy that will pay the beneficiary a death benefit that is equal to one year of your salary. That is not nearly enough. My advice has always been to aim to buy a term life insurance policy with a death benefit that is at least 20x the annual income your beneficiaries need. I know that sounds like a huge sum, but term life insurance is incredibly affordable. Cheap actually! You can shop for term life insurance at selectquote.com and accuquote.com.

8. Always Saying Yes to Your Loved Ones

If someone you love asks you for financial help, I know your immediate impulse would be to say “of course.” I think that’s potentially a costly mistake for both of you. For starters, if someone asks you for a loan, you should stop and consider why. Same goes with co-signing for a loan. If a lender isn’t willing to make a deal with them, you should be questioning why they couldn’t qualify on their own.

The other important issue is that you should never give financial assistance to someone if it puts your own financial security at risk. For example, taking a big chunk out of your emergency fund to help someone puts you at risk. My rule is that you only help if you are sure the person asking for your assistance is responsible. And you only help if you can afford to.

Ask yourself how you would feel if the money was never paid back. Would it impact the relationship? Would it be a financial hit to you? If you answer yes to either question, take that as a sign you shouldn’t offer money. Same goes with co-signing a loan, as that legally means you agree to pick up the tab. Remember, it is far better to say no out of love, than yes out of fear.

9. Forgetting to Review Your Options

Your financial goals and needs will change as time passes, so what worked last year may not be your best choice this year. As an example, employer-provided dental insurance is a nice benefit. But if you switch jobs and need to purchase your own coverage, a dental savings plan could be a better buy. Keep educating yourself about your financial options so that you can make smart decisions throughout your life.

Dental savings plans are an affordable alternative to traditional dental insurance. Plan members report saving an average of 50%* on their dental care. Find out more about the advantages of dental savings plans vs. dental insurance and use the calculator below for a quick look at how much you can save on virtually all of your dental care.

Suze Orman has been called “a force in the world of personal finance” and a “one-woman financial advice powerhouse” by USA Today. A two-time Emmy Award-winning television host, New York Times mega bestselling author, magazine and online columnist, writer/producer, and one of the top motivational speakers in the world today, Orman is undeniably America’s most recognized expert on personal finance. Visit Suze’s website, http://www.suzeorman.com, to access a wealth of resources that will help you to get smart about your money. And make sure to listen to Suze Orman’s Women & Money podcast.